If you’re a parent, you might already be familiar with Tax-Free Childcare, which is a government scheme created to help you with your childcare costs. The scheme pays 20% of childcare costs up to £2000 a year. For example, for every £8 you pay into a childcare account, the government adds an extra £2.

Who is Tax-Free Childcare For?

Tax-free childcare is a nationwide scheme introduced in 2017, available throughout the UK. It is open to all parents with children aged 11 years or under, or 16 years or under if your child has special needs / is disabled.

Who is Eligible for Tax-Free Childcare?

To benefit from tax-free childcare, you must meet the following criteria:

- You and your partner, must both be over 16 years old and expect to earn an average of £183 per week. This is equivalent to 16 hours at the National Minimum or Living Wage over a three-month period.

- If you or your partner are on maternity, paternity, or adoption leave, or if you’re unable to work due to disability or caregiving responsibilities, you may still be eligible.

- You are not receiving Tax Credits, Universal Credit or Childcare Vouchers.

- You earn under £100,000 annually.

Where Can I Find Out About Tax-Free Childcare Eligibility?

You can easily find out your eligibility status and the savings you can make with Tax-free childcare on the Childcare Choices government website.

To find out more information on all the childcare schemes available, check out our article on what is Childcare Choices.

What is the Difference Between Tax-free Childcare and Childcare Vouchers?

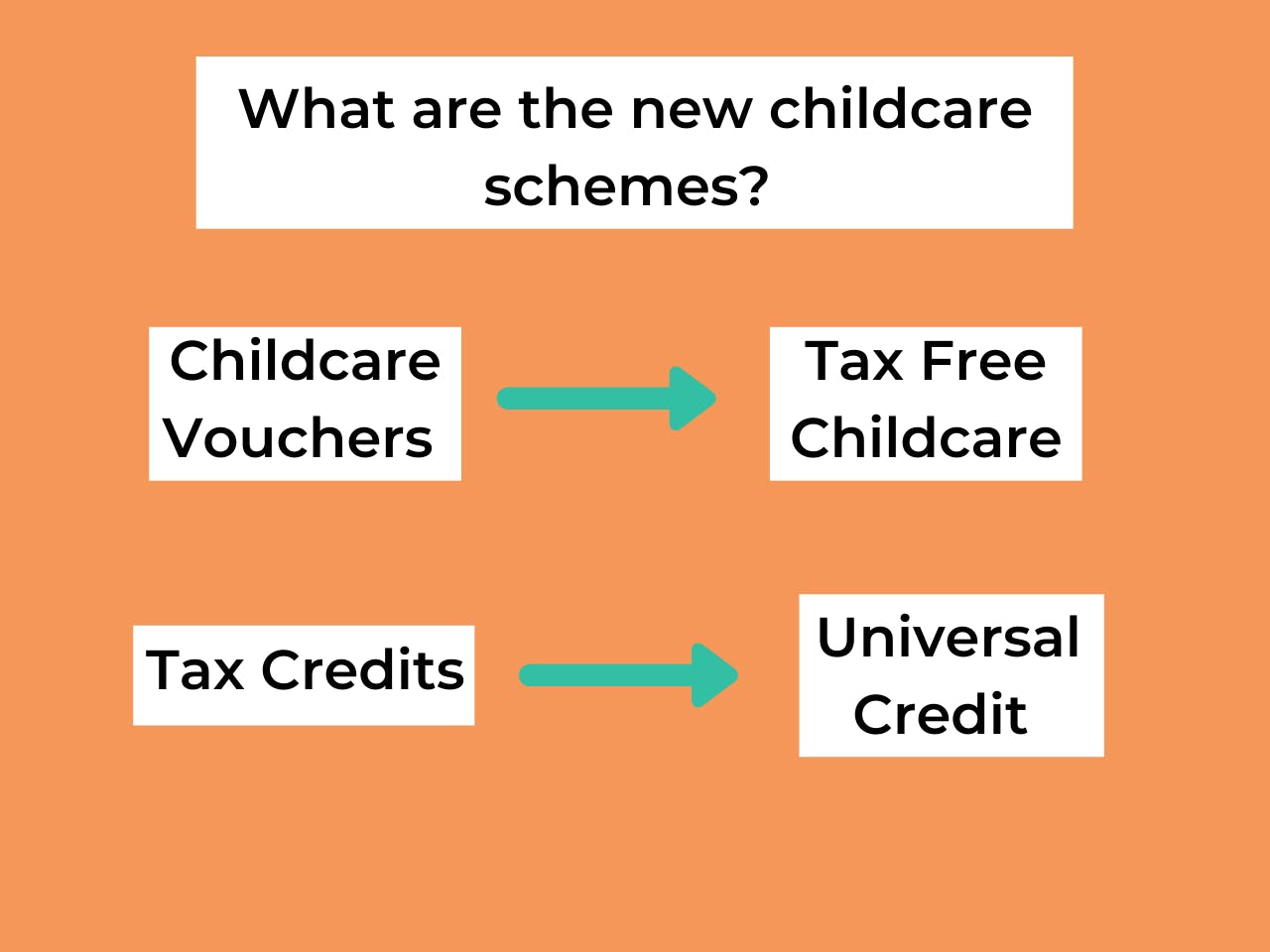

With so many programs offering similar benefits, it can be confusing to keep track of them all. Childcare vouchers, which are being phased out, were replaced by Tax-Free Childcare. Since October 2018, new members can no longer join the Childcare Vouchers scheme.

If you were already using Childcare Vouchers before 2018, you can continue using them without a deadline. However, if you switch to Tax-Free Childcare, you cannot switch back once you inform your employer. Remember to notify your employer within 90 days if you decide to change to the Tax-Free Childcare scheme.

What is the Difference Between Tax Credits for Childcare and Universal Credit for Childcare?

Please note that if you receive Tax Credits or Universal Credit, you cannot use Tax-Free Childcare.

Tax Credits were the scheme before Universal Credit, designed for working families with children under 16, or under 17 if the child has special needs or is disabled. This scheme covered up to 70% of childcare costs for services like nurseries, childminders, and after-school clubs. It stopped accepting new applicants in June 2019, but if you’re already enrolled in Tax Credits, your situation won’t change for now.

You can also find out more about other government schemes in our articles about Childcare Choices and how to apply for 15 and 30 hour free childcare.

Here at Yoopies, we understand the importance of finding trusted and affordable childcare. With thousands of registered nannies and childminders available on the platform, you can easily find your ideal childcare provider in just a few clicks.